Lou Barnes is a mortgage broker and nationally syndicated columnist based in Boulder, Colo. He writes for Inman News, an online real estate trade news service. He's one of the best, most informed real estate business writers around. He says interest rates may have topped out:

"Connect the dots…the Fed is reacting, leading only in its insistent forecast of economic slowdown ahead, a forecast joined by everyone, if only because every central bank on the planet is working to make it so. One scare story in the bond market has held that foreign rate hikes would drive up U.S. rates; didn't happen on Thursday, maybe because frightened stock money went to bonds, more likely because the whole world economy is topping out.

One of the most disciplined investment managers, Brad Bickham (Sergeant Bickham Lagudis) I think is on the trail of the right question, now: how slow will the slowdown be? Forget whether, and count on a reduction in inflation pressure. Bickham is looking for a soft landing (really hardly any landing at all), and his corporate earnings case is a good one. However, the behavior of stocks and commodities make me uneasy, especially about the deeply underpriced risk of credit default as central banks conclude four years of the easiest money any of us has ever seen."

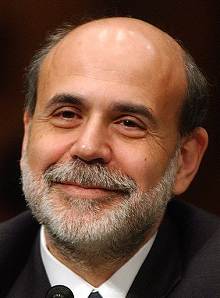

WSJ.com - Bernanke and Inflation: A Headache for Markets

No comments:

Post a Comment